Speculators with visions of taking advantage of day trading perspectives often look for correlations within asset classes to help gain an outlook on another trading vehicle they may be considering. The problem with this like many things for day traders is that sudden gyrations in asset classes technically are often affected by positioning from large players who do not care what the 'minnows' are doing. Institutional trading is frequently done with long-term considerations.

The Forex market has seen the USD grow stronger since the middle of July against most major currencies. At the same time charts via U.S Treasuries clearly demonstrate yields increasing. This is not a coincidence. Market behavior remains anxious as financial institutions look to lock in a certain amount of 'guaranteed' returns. Recent economic data has been lackluster from the U.S and this week important inflation numbers are certain to influence existing sentiment.

A side note for day traders who like to study economic data, 'revisions' via published data is starting to set off concerns among traders. Revisions to previous statistics reported are becoming a talking point among investors who believe the numbers they are looking at from many countries, including the U.S, need to be given a certain degree of skepticism. The Wall Street Journal published an article about this a couple of weeks ago.

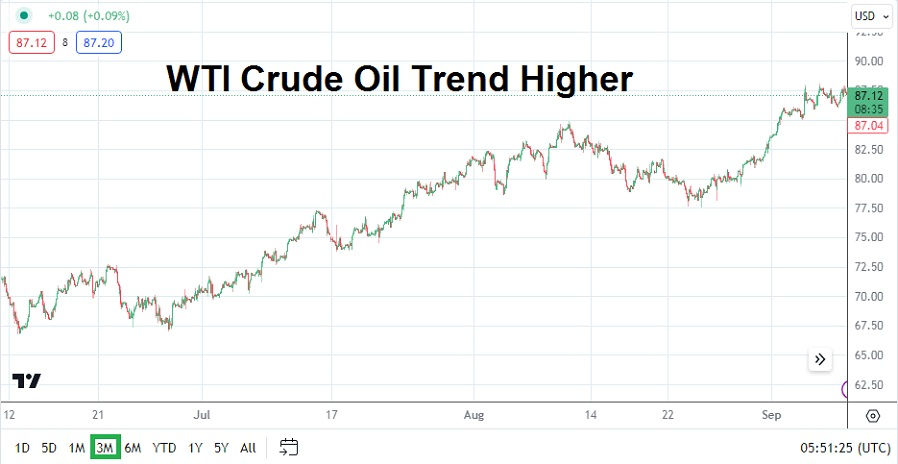

In the coming days the price of Crude Oil may make headlines as the commodity enters this week near values last seen in November of 2022. The high price of Crude Oil will spark vocal warnings about potential inflation dangers. Speculative elements within the energy sector will be active and hope to take advantage of its trend. A sustained move above 90.00 USD per barrel would be intriguing.

Some analysts might try to correlate higher energy prices to increased demand from global manufacturing sectors, but this could be questionable considering many spheres are suffering from recessionary pressures. But again, the real facts and dynamics behind a potential sustained climb of Crude Oil prices are complex.

Smaller traders need to understand the news they are reading today was known by 'insiders' many days before and they have already acted on their knowledge to take advantage of prices.

The cuts in production from Saudi Arabia and other producers has sparked speculative influence, and perhaps the narrative that outlook for more Crude Oil demand could build if the U.S continues to demonstrate a 'soft landing'. The chatter and explanations for changes to price are almost limitless and day traders need to be aware they will not be privy certain information.

This leaves the door open for day traders to consider trying to understand market behavior within the financial world. The answer for short-term speculators who are wagering on price direction is not a simple interpretation of technical charts, they should also consider fundamental knowledge of the asset mixed with an understanding of current market dynamics as sentiment shifts among institutional players.

In other news to look out for this week, traders who are active in the cryptocurrency space should continue to monitor the support levels that Bitcoin and Binance Coin are traversing. Incremental drops in value continue to be seen and a sustained reversal higher has been difficult to attain.

Monday, 11th of September, China New Loans - the amount of borrowing from businesses and consumers within China will provide insights regarding the strength (or weakness) of the domestic economy.

Tuesday, 12th of September, U.K Claimant Count Change and Average Earnings Index - the jobs numbers from the U.K will provide the GBP/USD with a bit of additional impetus. The U.K economy is in the spotlight and critics have become loud as many point to Brexit problems, which they claim are causing complications. However, within a global economy that is under pressure the fact that conditions in Britain are difficult doesn't take a lot of time to find other correlations.

Tuesday, 12th of September, Germany Economic Sentiment via ZEW - the reading is expected to show a negative outlook again from the responses of institutional investors based in Germany. A result of minus -15.0 is the forecast. The report could shake the EUR/USD a bit momentarily.

Wednesday, 13th of September, U.K GDP - growth numbers will certainly get plenty of attention for Britain. The anticipated number is minus -0.2%. If the result is worse than the recessionary estimate it could spark more negative sentiment.

Wednesday, 13th of September, U.S Consumer Price Index reports - inflation statistics will be studied carefully and impact Forex immediately if the published results do not meet expectations. The Federal Reserve, institutional investors and the broad financial markets will react to the CPI data.

Thursday, E.U European Central Bank Main Refinancing Rate - the ECB is not expected to make any changes to borrowing rates. The European Central Bank is also anticipated to warn that economic conditions remain challenging and they are monitoring inflation and growth. Anything more than these words via the ECB Monetary Policy Statement and Press Conference could spark some EUR/USD price action.

Thursday, 14th of September, U.S Producer Price Index - like Wednesday's inflation numbers, the PPI statistics will affect market sentiment regarding outlook and interpretations regarding the potential responses from the Federal Reserve.

Thursday, 14th of September, U.S Retail Sales - this data will give traders insights regarding the spending habits of U.S consumers, which is a key barometer for equity traders regarding consumer driven stocks, and also because an increase would underscore solid economic sentiment from the public.

Friday, 15th of September, China Industrial Production and Retail Sales - these two reports will provide additional insights about the Asian giant. Global investors continue to be concerned about the direction of the Chinese economy. Slight gains are forecast for both publications.

Friday, 15th of September, U.S University of Michigan Consumer Sentiment - the preliminary report is expected to have a reading of 69.2 which would be below the previous reading.

Comments