Simply put it is too easy to be nervous when contemplating the markets if you are a day trader. Today the Non-Farm Employment Change data will be published in the U.S and the Middle East conflict continues to reverberate. However, if a speculator looks at the markets they will see risk adverse trading has produced rather predictable results in many assets.

Gold remains within its higher known price realm, and WTI Crude Oil is trading around 74.00 USD after President Joe Biden for some odd reason felt it was necessary to discuss publicly potential targets Israel may pursue against Iran. Also, Biden's influence on the decision making in the Middle East appears to be fleeting and this is making financial institutions additionally anxious.

The employment numbers from the U.S today are vital regarding the Federal Reserve's interest rate decision for November. If today's jobs statistics come in weaker than expected this could help the USD lose some ground in Forex against major currencies. However, there is also the prospect that headwinds via concerns from the Middle East will keep a steady diet of risk adverse trading a driver for behavioral sentiment going into the weekend. Forex remains dangerous for day traders in the near-term.

Traders who believe more volatility will come because of the ramifications in the Middle East can certainly pursue assets like gold and WTI Crude Oil. Correlations with risks that are flourishing as potential conflict brews is not a foolish wager, but it is also difficult for speculators to pursue these trades via CFDs offered by many brokers, this because day traders may have to hold onto their positions too long in order to take advantage of potential moves. If a speculator can pursue options positions via future markets, this could prove to be a solid tool, provided strike prices are not outrageously expensive and the prospect of time erosion is not too fast.

This is not an easy time to be a day trader and those that are nervous should choose to remain on the sidelines. U.S Treasury yields have increased this week as behavioral sentiment has become jittery. It is important to remember however that short-term reactions are frequently not related to long-term outlooks. Treasury yields have come down significantly in the mid-term and remain within the lower part of their range. The same can be said for equity indices this week. The notion that the world will not spin out of total control should be considered. Risk adverse trading will certainly begin to gravitate towards optimism at some point, it is only a question of time.

The point for day traders is this, it is easy to be nervous. Watching television all day and looking at smartphones for updates on developing sagas does not help create calm. Large institutional traders have been within these volatile waters before. Yes, large players also have to remain diligent, but they will certainly do their best to remain realistic. Short-term price velocity often leads to reversals and you can be assured large financial institutions will take advantage of this insight.

If today's U.S jobs numbers meet or come around expectations this would be a welcome result for markets which appear to be standing on fragile ground. Traders while looking at today's Non-Farm Employment Change numbers and Average Hourly Earnings statistics should also be mindful of downward revisions to previous reports which have occurred almost consistently for a handful of months. Initial trading reactions to the publication of jobs data are often met with sudden reversals due to revisions in numbers being spotted a few moments later by analysts.

As for the Middle East, financial institutions and traders are all in the same boat. Patience and deep breaths are needed. The trillion dollar question lurking, is there an end game that is viable and can restore calm, or will retribution and hatred cause the conflict to spiral out of control?

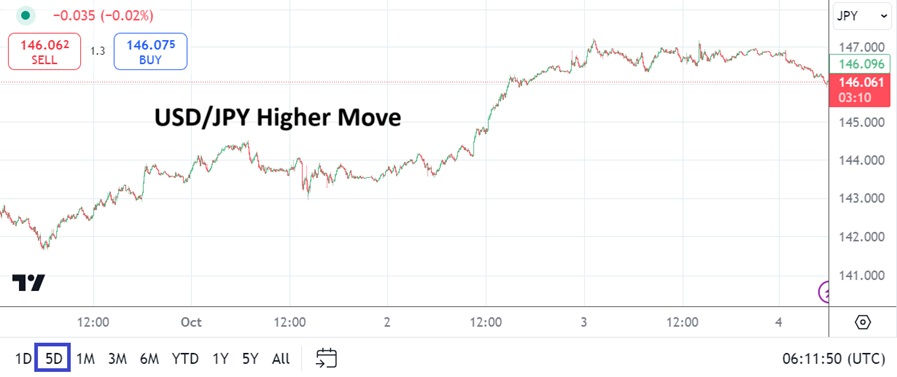

The volatility seen in Forex the past handful of days, including the USD/JPY, have caused dynamic results. There is no denying risk adverse trading has taken hold of the marketplace. The trifecta of U.S jobs numbers today, tensions in the Middle East, and the approaching U.S election have set the table for a tumultuous meal. At some point day traders may want to walk away from the table to avoid indigestion and return only when tranquility has been restored.

Comments